Blind Persons’ Association is registered under section 80G(5)(VI) of the Income Tax act, 1961. Under this section 50% of your donation to our fund shall qualify for exemption from income tax. Moreover, the qualifying amount must not exceed 10% of your gross income. While computing the deductible amount under section 80G, first the aggregate of the sums donated has to be found out. Then 50% of the donated amount has to be found out and it should be limited to 10% of the gross total income. If such amount is more than 10% of the gross total income, the excess will be ignored.

Illustration of 80G Exemption

Let us make it clear through an example. Suppose, your gross annual income for a financial year is Rs. 10,00,000. You donate to our Association the sum of Rs. 2,50,000. In this case 50% of your donated amount, i.e. Rs. 1,25,000 will qualify for tax exemption. However, this qualifying amount must not be above 10% of your total income, i.e. Rs. 1,00,000. So, in this instance, the actual amount eligible for deduction from income will be Rs. 1,00,000.

The ultimate tax benefit depends on the existing rate of income tax. In this particular case the qualifying amount of Rs. 1,00,000 will deducted from the donors taxable income.

The qualified amount of Rs. 1,00,000 should be entered in the section devoted to 80G page, deductions under Chapter VI-A in the income tax return form. This facility is available to all taxpayers including individuals, companies and any other organisation. The money receipt should contain the 80G exemption order number, PAN of the donee organisation and date.

80G Exemption for Financial Year 2019-20

80G exemption will turn out to be a signifacant tax-saving option for some taxpayers from financial year 2019-20. Suppose, a taxpayer’s taxable income is Rs. 5,01,000. His net payable tax would be Rs. 12,700.

Now if he pays a donation of Rs. 2,000 to an organisation like Blind persons’ Association having 80G benefit for its donors, his taxable income will be Rs. 5,,00,000. His net payable tax will be Rs. 12,500. Since his taxable income is within the threshold limit of Rs. 5,00,000, it will be eligible for rebate of Rs. 12,500 under section 87A. Thus his net payagle tax will be nil.

Thus a donation of Rs. 2,000 saves income tax of Rs. 12,700.

We know that none of the donors donates for mere benefit of income tax exemption under section 80G. The purpose of this post is to show how our donors may take advantage of the benefit of 80G exemption granted by the government. Charity has helped us continue our services to the blind people in need.

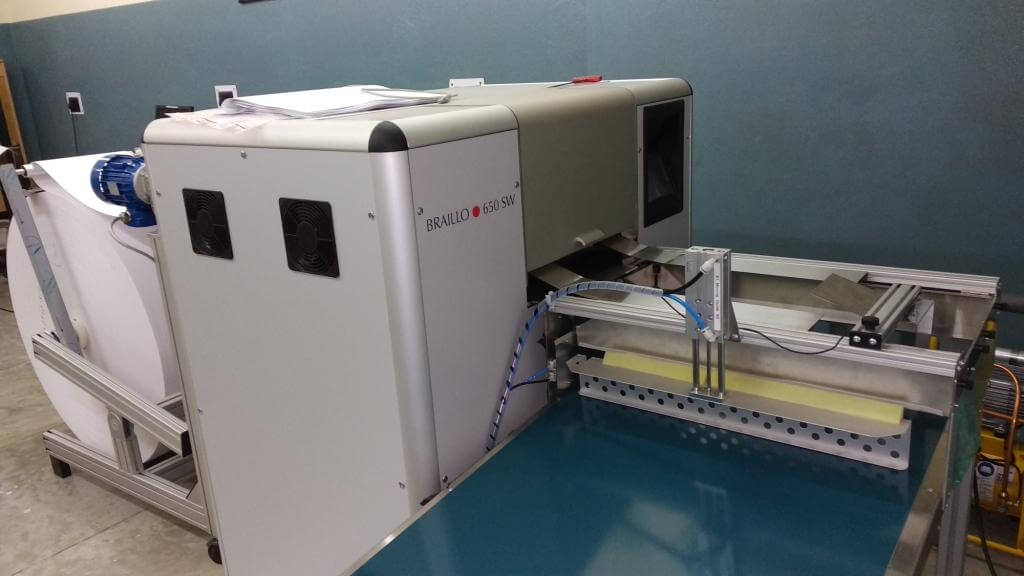

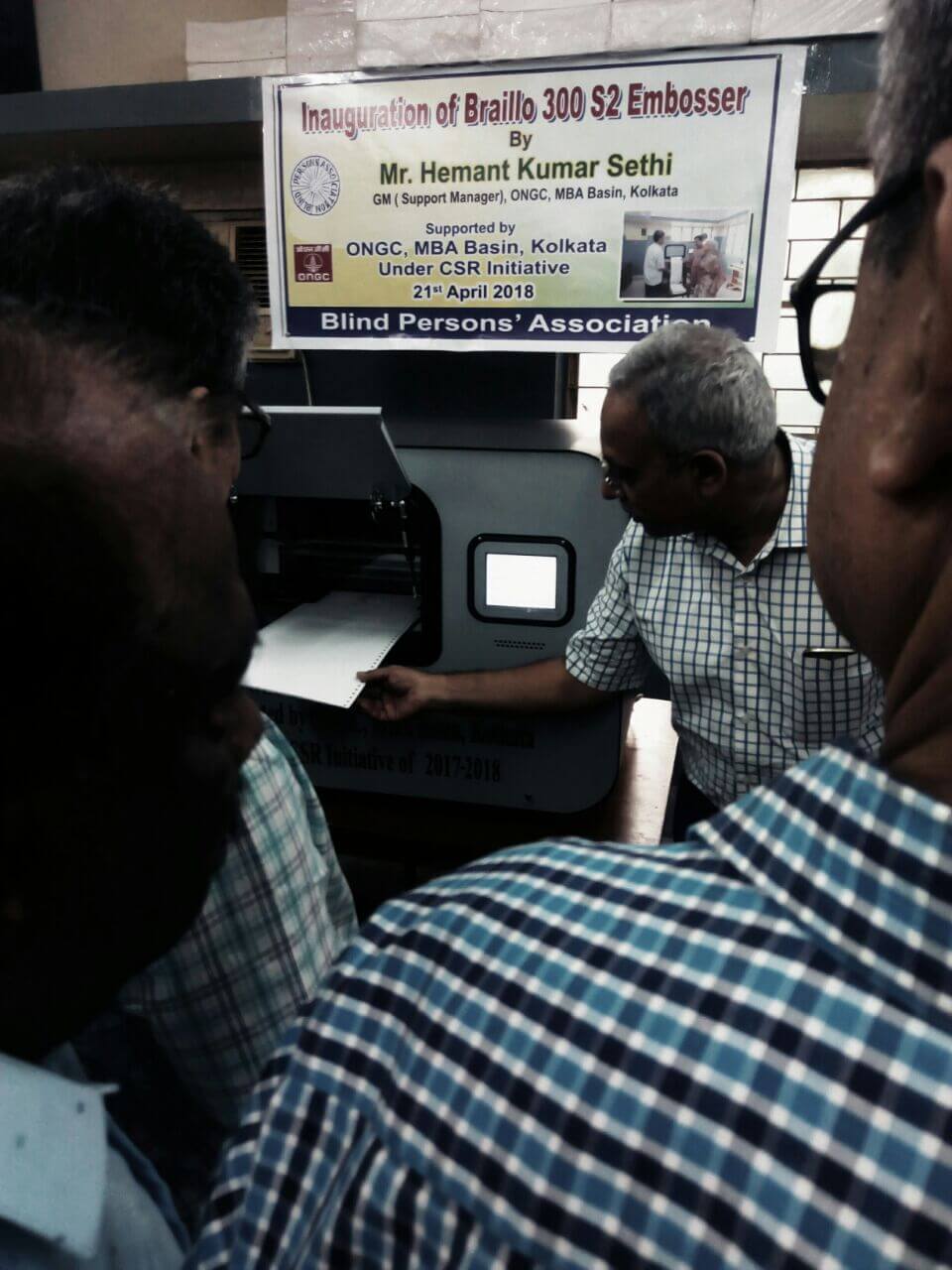

We conduct three blind schools and a Braille press and library in different districts of West Bengal. Besides, we record talking books for blind students and people with some form of print disability. Your charity will help us in maintaining these services.