Donate to Blind Persons’ Association. It helps us promote education of blind children and you are honoured for this donation by Government of India through 50% exemption from Income Tax u/s80G.

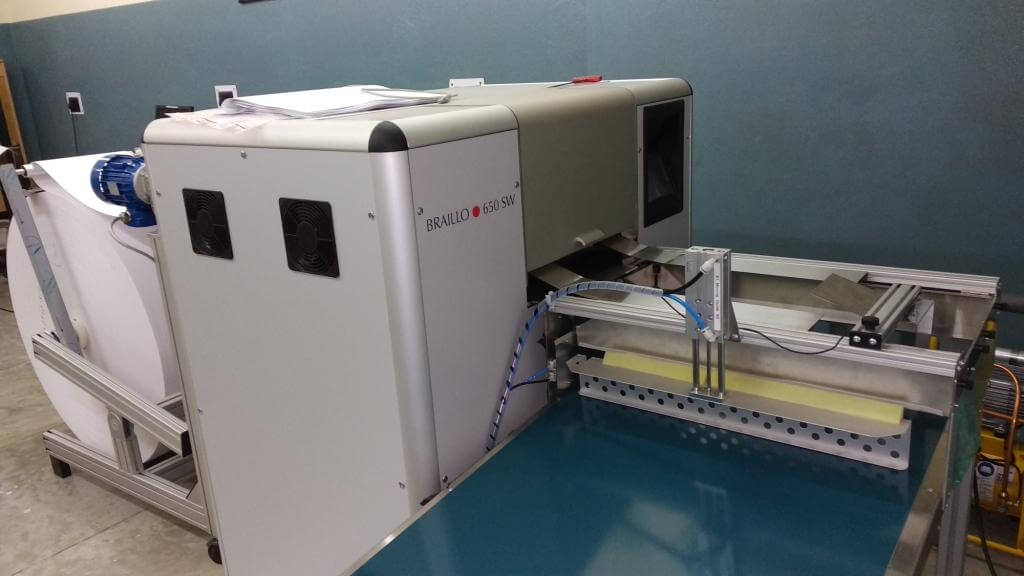

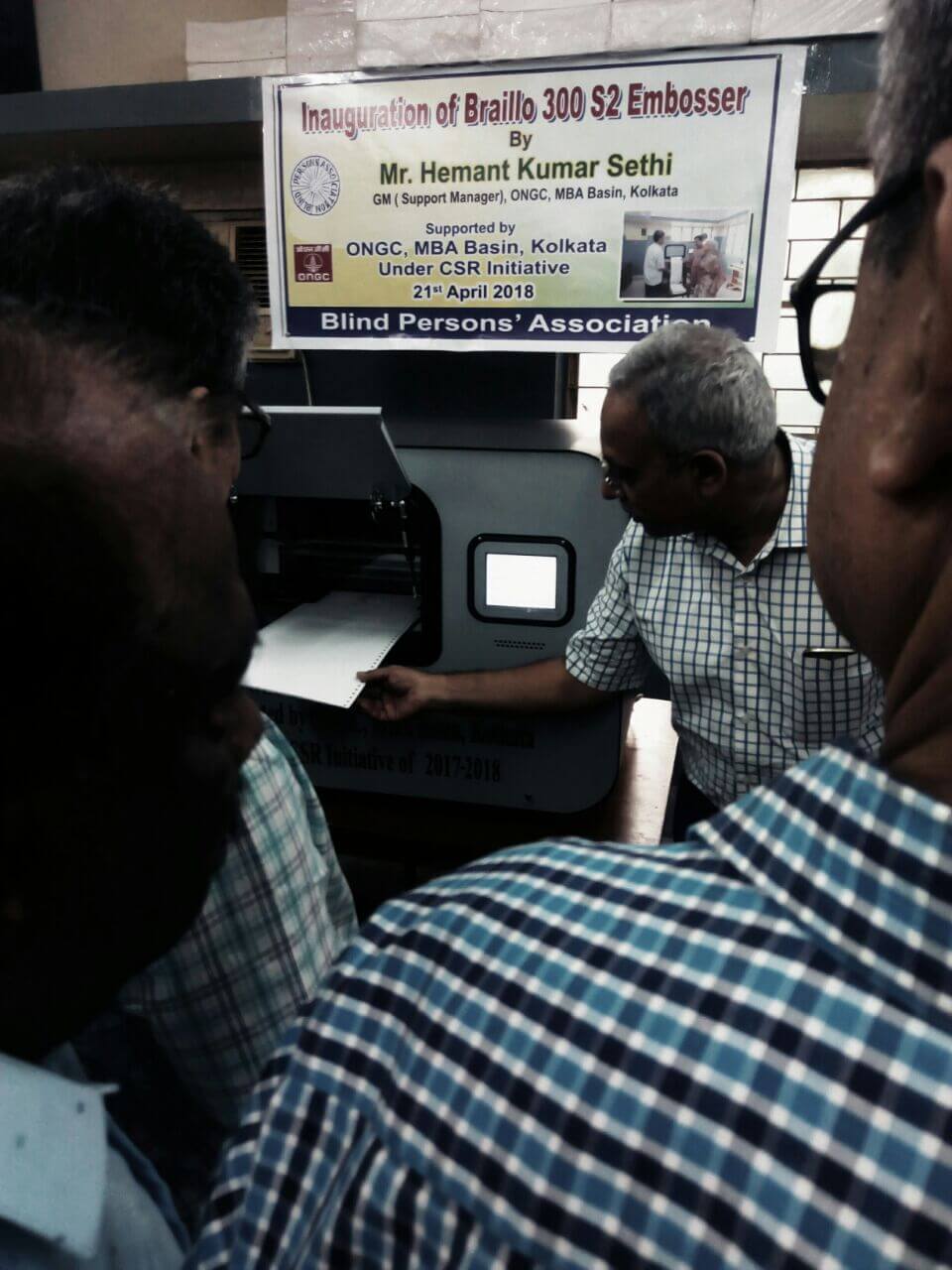

We conduct blind schools and a Braille press and library in different districts of West Bengal. Besides, we record talking books for blind students and people with some form of print disability. Your charity will help us in maintaining these services.

Donation to Corpus Fund

You may also consider making a donation to our corpus fund. This contribution to corpus fund will not be used for recurring expenditure as laid down under Section 11(1)(d) of Income Tax Act, 1961 . Simply send a letter with your specific direction that you have made this donation to the corpus fund of Blind Persons’ Association.

Your donation to Blind Persons’ Association is eligible for exemption from taxible income u/s80G (5)(VI) of the Income Tax Act, 1961 vide 80G Certificate with registration number AAAAB3854CF20222 Dated 31 December 2021 valid up to assessment year 2024-25.

Donation by Direct Cheque

Cheques or demand drafts for donation should be drawn in favour of Blind Persons’ Association payable in any scheduled bank in Kolkata and may be sent to

Blind Persons’ Association

6B, Panchanantala Road, 2nd Floor,

Kolkata — 700029.

Details of Bank Account

You may send donation by NEFT directly to our bank account. The details are as follows:

| Account Holder | Blind Persons’ Association |

| Bank & Branch | IDBI Bank, Narendrapur Branch |

| Current Bank Account Number | 0419102000010292 |

| IFS Code | IBKL0000419 |

Please remember that you must send us by email your name, address and one of the seven IDs along with your transaction ID, date and amount immediately after the donation. We need this information for sending you a valid receipt, and Saving Income Tax chargeable on anonymous donation at 30%.

Please note that we have to e-file details of donation in Form No. 10BD; otherwise donors will not be allowed exemption on donation u/s80G of the Income Tax Act, 1961. These details include name and address of donor, amount of donation, mode of payment and any one of the following seven IDs:

- Permanent Account Number

- Aadhaar Number

- Tax Identification Number

- Passport number

- Elector’s photo identity number

- Driving License number

- Ration card number

All donors including foreign donors who have paid online through Payumoney are also requested to send us one of the seven IDs. Your privacy will be fully protected.

Foreign donation

This organisation is registered under the Foreign Contribution (Regulation) Act (FCRA) 2010. So foreign donors may also contribute to our fund. They are requested to contact us by email for any information.

Foreign donors may directly send cheque to our office. The cheque should be sent with a letter from the donorclearly stating the purpose as charitable donation, an id proof, and address proof. Non-personal donors must send us some document of incorporation indicating the country of origin.

Problem in Income Tax Return

We understand that some donors faced problem in entering donation amount on the 80G page while e-filing Income Tax Return. Donors are requested to select the fourth option, i.e.

D. Donations entitled for 50% deduction

subject to qualifying limit

The amount should be entered in the appropriate field. If donation is made in cheque or NEFT or draft mode, it should be entered in Other Mode. If it is in cash, it should be written in the Cash Mode.

Do not enter 0 or any other character in any other field if you have not paid donation to any other organisation.

Please note that cash donations above Rs. 2,000 is not eligible for tax exemption u/s 80G with effect from 1 April, 2017. You may read more on 80G exemption from our site.