Assistive devices used by physically challenged persons are going to cost more in the new GST regime. All such items which are at present exempted from different forms of taxes like, sales tax, excise and customs duty, will attract 5 to 18 percent tax from 1st July, 2017 onwards. The credit of finding out this new way of earning some extra revenue for the government treasure goes to the GST Council meeting held at Srinagar on 18th May last. Just to mention a few decisions of the GST Council, 18 percent duty will be imposed on Braille type-writer and car for physically challenged persons. The GST Council has proposed a 12 percent duty on Braille paper, Braille watches and hearing aids. 5 percent duty has been proposed on parts of essential assistive devices like artificial limbs, wheel chair, tricycles, crutches, walking frames and braillers. Companies do not consider us prospective customers; the government does.

Section 17 of the Rights of Persons with Disabilities Act, 2016 (put into effect on 15th June, 2017) proposes among other things measures for promoting and education for persons with disabilities:

17. The appropriate Government and the local authorities shall take the following measures for the purpose of section 16, namely:– ……

(g) to provide books, other learning materials and appropriate assistive devices to students with benchmark disabilities free of cost up to the age of eighteen years.

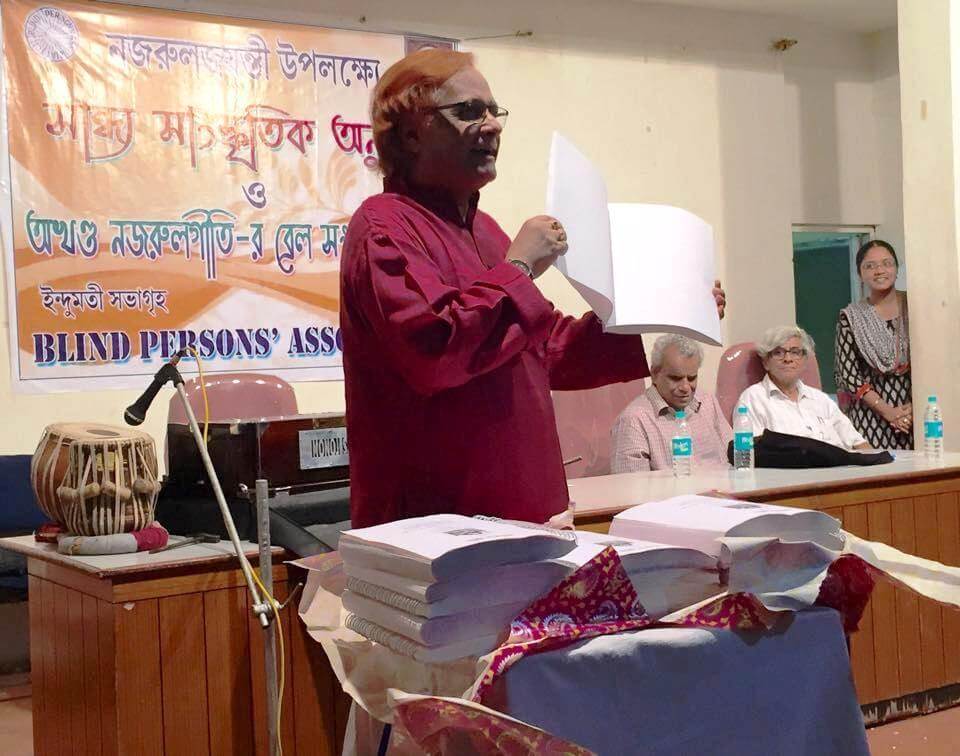

Section 29 of the same Act further lays down provisions for facilitating cultural and recreational activities of persons with disabilities:

29. The appropriate Government and the local authorities shall take measures to promote and protect the rights of all persons with disabilities to have a cultural life and to participate in recreational activities equally with others which include,– ……

(g) developing technology, assistive devices and equipments to facilitate access and inclusion for persons with disabilities in recreational activities ……

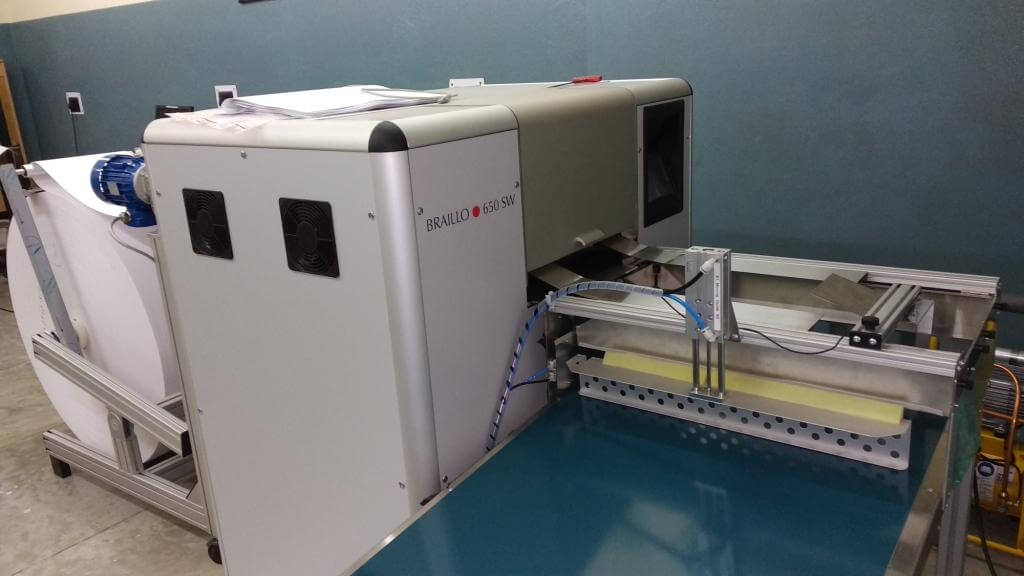

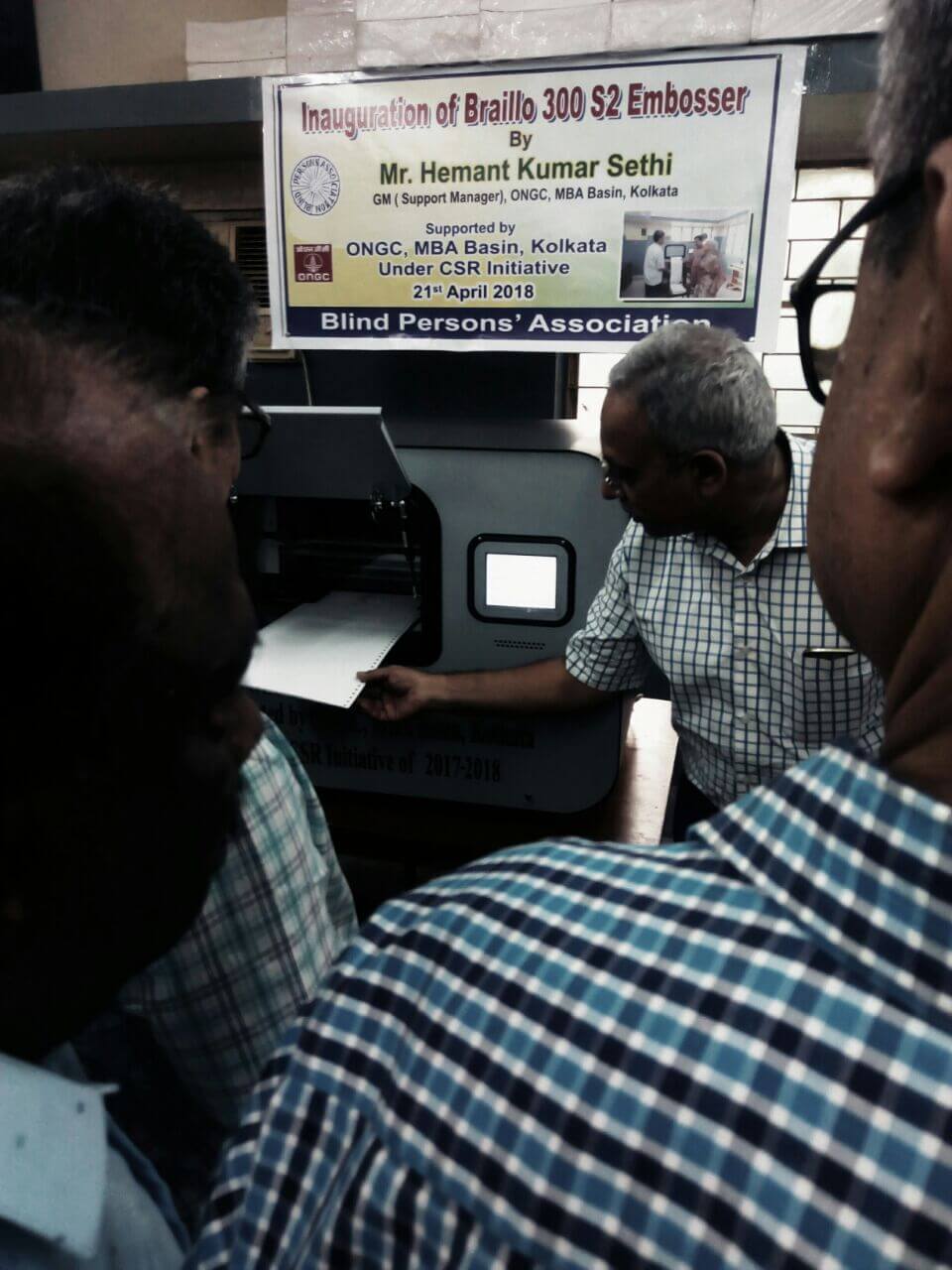

We wonder if hon’ble members of the GST Council remembered at all the Rights of Persons with Disabilities Act, 2016 during the consultation. We cannot believe that one wing of the Central Government is seeking to promote development and use of assistive devices, while another wing is levying taxes on artificial limbs, crutches and Braille paper. We do not know how much revenue these assistive devices will add to the exchequer. But the extra expenses will cost physically challenged persons a lot. A very negligible section of the visually challenged persons can read Braille books. These books are already 3 to 5 times higher than print editions, taking into account the cost of paper alone. 12 percent tax on Braille paper will make Braille books costlier. Blind Persons’ Association is one of the handful of producers of Braille books in India. Very few organisations have dared to produce Braille books owing to excessive cost of production and lack of purchasing power of the visually challenged readers.

Hearing aids, artificial limbs and wheel chairs are still a dream for many physically challenged persons. They will forget even to dream. In India hardly a few non-profit organisations provides physically challenged persons with different aids and appliances. They have to depend on very limited resources.

There is yet another aspect. Just one reputed company makes Braille watches on a small scale. Levy of 5 percent tax will not encourage this watch company. Any other company will think twice before producing any assistive device.

The quality of assistive devices produced in India is not up to the mark as corporate houses seldom venture in this barren field. The GST Council should have considered the effect of these new taxes on this non-profit industry.

Blind Persons’ Association and many other organisations have appealed to the Union Finance Minister to refrain from levying any duty on all assistive devices. These devices are already too costly without tax. New taxes will mean extra burden for the users many of whom may have to dispense with essential equipments like hearing aid and wheel chair.